Little Known Facts About How Long Does Chapter 7 Bankruptcy Last.

Any type of bankruptcy, which includes Chapter seven and Chapter eleven, will provide a amount of personal debt relief by way of an computerized stay (i.e., creditors are prohibited from speaking to you once your bankruptcy case is filed). An automated continue to be will also halt any wage garnishment attempts. Get Files

Personal debt settlement is one of the most effective tips on how to resolve a credit card debt and save money. We’ve developed a tutorial on how to settle your financial debt in all 50 states. Learn the way to settle in the state with a simple click and check out other credit card debt settlement methods down below. How you can Settle a Financial debt in Alabama

You can get a repayment system that works in your case. If you've been unsuccessful in negotiating a restructured repayment approach with your creditors, bankruptcy could make it easier to get a system that actually works on your funds.

Then will come a 2nd counseling session termed “debtor schooling,” classes on handling credit card debt as well as other particular finances presented, yet again, by nonprofit credit counseling companies.

What awaits the bankrupt individual about the sunny facet of the discharge? Possibly — with any luck , — a complete new way of contemplating income.

Chapter thirteen bankruptcy, which will allow customers to arrange and repay some in their debts while removing the rest, stays in your credit report for seven several years. Notice that these timelines commence about the filing date for your bankruptcy, instead of from the day your bankruptcy is discharged. In keeping with Experian, among the 3 credit bureaus, particular accounts which are delinquent when A part of a bankruptcy are going to be deleted seven years in the date you ended up look at here in the beginning late with all your payment.

Bankruptcy isn’t the top of the entire world, but the implications can last nearly a decade or longer. In case you end up in the unfortunate placement of getting submitted for bankruptcy, your best guess is Understanding as numerous lessons as you could and concentrating the remainder of your interest regarding how to Develop a far better upcoming.

Also, use thirty% or fewer within your offered credit score—as professionals suggest—to keep up a lower credit rating utilization ratio.

Chapter seven filings could be rejected for a range of motives, between them: debts for money/home obtained by Fake pretenses; debts for fraud; debts for malicious injuries when contested via the injured creditor; or debtor, without sites satisfactory rationalization, helps make a material misstatement or fails to deliver documents/information and facts relevant to an audit in the debtor’s circumstance.

Undecided how to barter a personal debt settlement using a debt collector? More Help We have been building guides that will help you understand how to begin the settlement conversation and raise your likelihood of coming to an settlement with just about every financial debt collector. American Convey

Despite the fact that the impact on credit history scores top article may perhaps diminish with time, bankruptcy can continue to influence credit score for as long because it’s portion of someone’s credit Full Report history reviews.

Home finance loan or car financial loans for which you're struggling to spend (but creditors can reclaim your house or car)

341 Conference: Also called the Assembly of creditors, You will be questioned beneath oath by your creditors or perhaps the trustee about your economical condition.

Look at all investmentsStocksFundsBondsReal estate and option investmentsCryptocurrencyEmployee equityBrokerage accounts529 college or university personal savings plansInvestment account reviewsCompare on-line brokerages

Danny Tamberelli Then & Now!

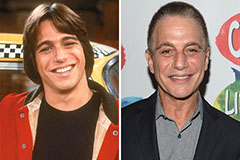

Danny Tamberelli Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!